Bristol Marine Insurance: Learning About Yacht Insurance

Bristol Marine Insurance will take the time to educate their clients on Yacht Insurance. For instance carrying the minimum legal coverage for boats can leave yacht owners exposed to potentially expensive risks. The professionals at Bristol Marine Insurance work with the owners to develop a custom risk profile to ensure that they are protected with appropriate coverage from top quality underwriters. Review some of the issues that impact risk and are typically excluded or severely limited in typical minimum coverage watercraft insurance policies.

Total Replacement Cost

The team at Bristol Marine Insurance will explain typical watercraft policies that will not cover the total loss of your vessel. With Insufficient coverage the cost to replace a large cruising yacht can be hundreds of thousands of dollars. Only limited number of underwriters can offer total replacement coverage.

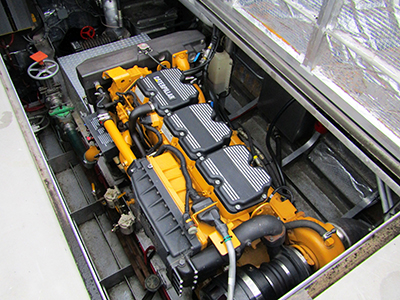

Mechanical Breakdowns

All boats, especially powerboats have a lot of systems and mechanical operating parts. Depending on the vessel length, make, model and purpose for your cruising needs, boats can have an extinctive operating system from mechanical to electrical. Protect yourself against the high cost to mechanical breakdowns.

Pollution Clean Up and Wreck Removal

Accidents on the water with pleasure craft are something to always be prepared for as a boat owner. An accident can expose you to more liability than just damage to your vessel. Most boat policies don’t protect you from the costs of pollution clean-up vessel salvage or wreckage removal.

Limited Navigation Area

Bristol Marine Insurance will protect you everywhere you go. Typical boat insurance coverage ends if you leave US waters. Ask Bristol Marine Insurance how to make sure you’re protected if you cruise outside of US waters to - Canada, Mexico, or other foreign destinations. Live your cruising dreams and be protected with us while you’re there.